Last Updated on October 18, 2022

OpenTaxSolver (OTS) lets you calculate tax form entries for Federal and State personal income taxes. It automatically fills-out and prints your forms. It performs the tedious arithmetic.

OTS is intended to assist those who normally prepare their tax forms themselves, and who generally know on which lines to enter their numbers. It is meant to be used in combination with the instruction booklet corresponding to a given form.

The OTS tax package is intended to be used with the Tax booklets published by your government for determining what numbers you need to enter, and then it assists you in doing the otherwise tedious calculations while showing the intermediate and final numbers. It takes care of the tedious and error-prone work.

OTS is intended for those who are comfortable doing their own taxes – especially those who have previously done their taxes and basically understand how to fill out the forms. OTS does much of the maths for you.

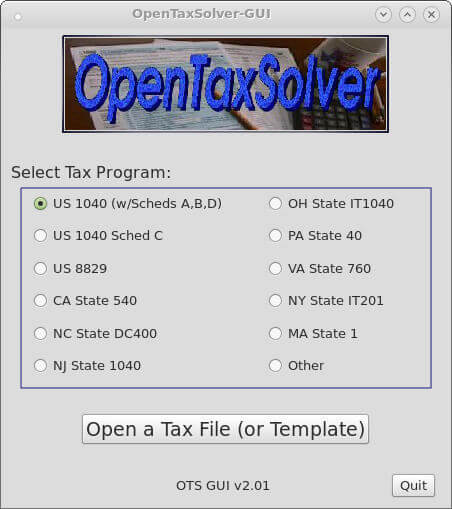

The OTS_GUI is the default Graphical User Interface. The GUI allows you to conveniently enter tax data, and then invokes the appropriate text program when you press the Compute button. Alternatively, you can directly enter your tax data by editing the text files with your favorite text editor, and then process it by invoking the appropriate tax-solver program. Most people nowadays use the GUI, so that is the default mode according to instructions in the package.

Behind the GUI is a text-window. It shows the actual commands the GUI uses when you press buttons. You can look at that, if you wish, to learn how to run the same commands directly from your command-line. Since the GUI is fairly self-explanatory, the detailed documentation focuses on how the core text programs work, for those interested.

Although originally created for US 1040 tax forms, the core routines have also been used to solve other tax forms, and for other countries or states. Some error checking is included.

This is free and open source software.

Features include:

- Graphical Interface or Console based.

- Straightforward – complete your tax returns quickly.

- Safe / Secure – Runs directly on your PC – no web connections or cloaked software.

- Contains programs and templates for:

- US-1040 – which also does the Schedules A, B, D, and forms 8949.

- Schedule C for US-1040.

- State Income Taxes for Ohio, New Jersey, Virginia, Pennsylvania, Massachusetts, and North Carolina. A beta-version version of the updated California taxes was added.

All updated for 2020 Tax-Year.

- Also contains an Automatic PDF Form-Fillout function:

- Supports all Federal Forms and State Forms.

- Saves time by filling out many of the numbers.

- You may still need to enter some information or check boxes that are not handled by OTS.

- Tested to work properly with many viewers.

- Edit your forms with Libre-Office.

Website: opentaxsolver.sourceforge.net

Support: FAQ, SourceForge Project Page

Developer: Aston Roberts

License: GNU General Public License v2.0

OpenTaxSolver is written in C. Learn C with our recommended free books and free tutorials.